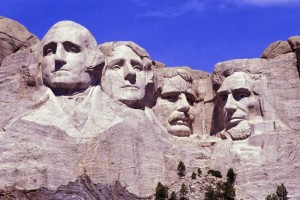

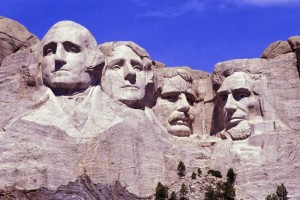

Happy Presidents Day!

Director, Wisconsin 529 College Savings Program

By Claire Whittington Director, Mississippi Prepaid Affordable College Tuition (MPACT) Program As parenting fears go, starting a college fund is right up there with sending your child to their first […]

January 28, 2014

Recently, President Barack Obama and First Lady Michelle Obama issued a call to action, requesting colleges and universities, foundations, businesses, non-profits, government officials, other leaders and individuals to make commitments to help assure that college becomes a reality for more young people. The objective is to help an increased number of students afford college and graduate with the skills they need to succeed. The call to action along with some of the commitments made in response to it can be viewed here:

By: Jodi Golden

Director of the Indiana Education Savings Authority

January 27, 2014

FAFSA? What in the world does that mean, you ask? Well, for those families that have a child nearing college, you’re probably familiar with this infamous acronym. FAFSA stands for the Free Application for Federal Student Aid. This is one of the most important documents a prospective college student may ever have to submit. This document helps determine your eligibility for federal and state student financial aid.

By: Betty Lochner, Director of Washington’s Guaranteed Education Tuition (GET) program & CSPN Chair

January 20, 2014

With the Martin Luther King Jr. holiday upon us, I have been thinking about what it means to be a passionate leader and what an important role education plays in influencing our growth as individuals and a society. Dr. Martin Luther King Jr. once said, “The function of education is to teach one to think intensively and to think critically. Intelligence plus character – that is the goal of true education.”

College Savings Plans of Maryland

During this past holiday season, I had the wonderful blessing of receiving an incredible testimonial from one of our Prepaid College Trust account holders that I think highlights just how committed some of our account holders are to the concept of a 529 prepaid tuition plan and how it provides them with peace of mind that they have saved for at least a portion of future college expenses.

By: Betty Lochner, Director of Washington’s Guaranteed Education Tuition (GET) program & CSPN Chair

January 6, 2014

Happy New Year! The holiday season has come to a close, but I love this time of year, because no matter how trying the past 12 months have been, you can focus on looking forward to what’s ahead. This year, I’m especially excited and honored to take on a new role as the CSPN Chair.

By Hon. Michael L. Fitzgerald

State Treasurer, State of Iowa

With the New Year quickly approaching, there is no better time than the present to start thinking about putting the finishing touches on 2013. Why not end 2013 with a bang by donating to a child’s future college fund? You can remember 2013 by possibly giving yourself multiple tax benefits at the same time.

December 23, 2013

Well it’s a condensed week for many of us as we enter the holiday homestretch. As we wrap up the year, we’d like to wish you and yours a joyous remainder of the holiday season and a happy and healthy New Year! We’d also like to challenge you to take a moment, hit pause and consider the following:

New Survey by College Savings Plans Network Offers Insights On Who is Saving for College and How The College Savings Plans Network (CSPN)—the nation’s leading objective source about Section 529 College Savings and Prepaid Tuition Plans— today released results of its nationwide 529 investor survey, presenting an analysis of the demographics and saving habits of American 529 plan investors

By Robin Lott

Executive Director for Michigan Education Trust

December 10, 2013

With Thanksgiving now a new memory, we are now smack in the middle of the holiday season. While you are busy decking the halls with bows and holly and searching for the perfect gift for the loved ones in your life consider this: why not give the gift of education? Higher education is a gift that keeps on giving and your state’s college savings program can help.

By Hon. Michael L. Fitzgerald

State Treasurer, State of Iowa

While you are looking for the perfect gift on-line Cyber Monday, make sure you visit www.CollegeSavings.org to find the perfect 529 plan. Rather than fight the crowds in the mall to find a gift that will be forgotten by next year, give the gift of college savings that will last a lifetime. State-sponsored 529 plans provide investors the opportunity to save for a loved one’s higher education costs and get a tax benefit for themselves at the same time. With some plans having an initial investment as low as $25 to open an account, it makes the perfect gift for almost anyone to give.