Why Save for College?

The gift of a college education is an investment that will last a lifetime and can open the door to a world of opportunity for your child or grandchild. Saving, even a little at a time, can make a big difference down the road. With the cost of a college education continuing to increase, the key is to start saving early and regularly.

-

-

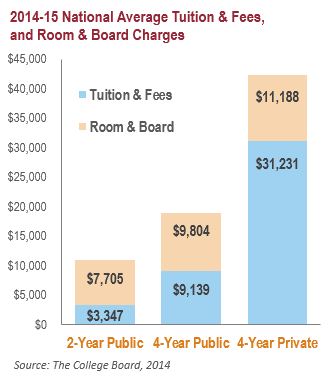

Rising Cost of Education

According to the College Board, the average cost for tuition and fees at four-year public institutions has increased 225% over the last 30 years (after adjusting for inflation), and these costs will almost certainly continue to rise. Saving for college can help with the increasing cost of a college education and help you be financially prepared when your children are ready for college.

-

-

Education Pays

Saving for your child’s college education is an investment in their future. The savings you make today pay off in an increased earnings potential in the future. According to the U.S. Census Bureau, four-year college graduates earn an average of $1 million more than high school graduates during their careers. The value of your investment in a college education will continue to grow for a lifetime. It will pay for itself both personally and professionally.

- Among men, median earnings of four-year college graduates were 69 percent higher than median earnings of high school graduates in 2011.

- Among women, median earnings of four-year college graduates were 70 percent higher than median earnings of high school graduates in 2011.

-

-

Saving Even A Little Can Go A Long Way

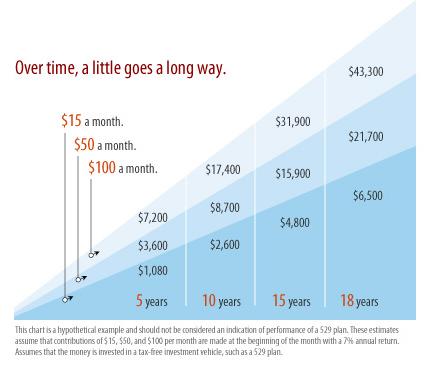

Remember – no matter how much you save, even a little can make a difference.

Like any other major investment, the key to saving for college is to start early and save regularly. By putting away set amounts at defined intervals, your money can grow as your child does. And before you know it, you’ll be just as ready for college as they are.

Set your college savings goals realistically. You may not be able to save enough for all four years of tuition, room and board, and other expenses – but you could save enough to give your child the right start.

A family that begins setting aside $50 a month when their child is born can accrue over $21,000, in an account that earns 7% interest per year, by the time the child turns 18.

-

-

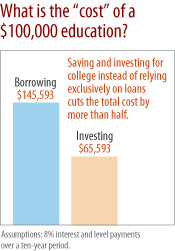

Reduce Reliance on Debt

More and more families rely on student loans to pay for college. Though low-interest loans are often available for college financing, paying even small amounts of interest can add up considerably over long periods of time. By saving for college, families can reduce their reliance on loans, earn interest versus paying interest and help their students leave college debt-free.

To better understand how 529 plans fit within the U.S. Dept. of Education Federal Financial Aid formula read: CSPN Report: Financial Aid Process Favors Saving for College May 2011.