One Year Closer to College

By Patricia Roberts Managing Director, AllianceBernstein L.P. & Chair, College Savings Plans Network Corporate Affiliates Committee As national College Savings Month nears its end, it couldn’t hurt to quickly check […]

By Patricia Roberts Managing Director, AllianceBernstein L.P. & Chair, College Savings Plans Network Corporate Affiliates Committee As national College Savings Month nears its end, it couldn’t hurt to quickly check […]

By Greg Dyer Chief Compliance Officer for the Utah Educational Savings Plan (UESP) September 21, 2015 In his 2015 State of the Union address, President Obama proposed eliminating one of […]

Today, the College Savings Plans Network published its 2015 Mid-Year 529 Report. Halfway through the year, 529 plans continue to see sustained growth. Highlights of the 529 Mid-Year Report include: Total […]

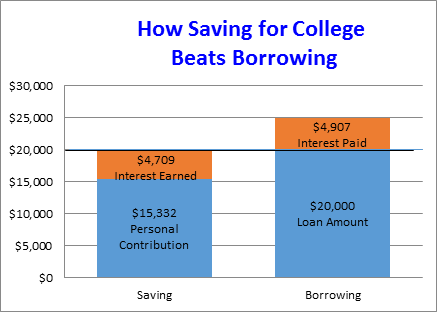

By Joseph Russo September 8, 2015 If you read anything about paying for college these days, you may have seen a column or two in which the author lamented that […]

By David Lawhorn Plan Administrator, Kentucky Education Savings Plan Trust August 31, 2015 For many years, one of my key job responsibilities has been to share information with families across […]

By Patricia Roberts Managing Director, AllianceBernstein L.P. and Chair, College Savings Plans Network Corporate Affiliates August 24, 2015 Forward movement by others can inspire us in countless ways to get […]

By Lael Oldmixon Executive Director, UA College Savings Plan and Scholars Program August 17, 2015 I am parent of two young children, a higher education professional, and the director of […]

By Mary Anne Busse Managing Director, Great Disclosure LLC August 13, 2015 Last week, representatives from 35 states, the District of Columbia and 19 private sector firms gathered in Chicago […]

By Betsy Hagen Associate Director for GET Operations August 10, 2015 “Hey Nana, I want to be an engineer when I grow up!” said one of my grandchildren. “I am […]

Sheila Salehian Senior Deputy Treasurer, State of Nevada August 3, 2015 As summer winds down and we are all bombarded with ‘back to school’ information, I am reminded, once again, […]

By: Daniel D. Reyes, CFA Principal, Vanguard’s Education Savings Group July 27, 2015 I’m in the earliest stage of college investing, saving for my son, who’s about to turn 2. […]