(Part 1 in a series based on the findings from the 2012 Mid-Year 529 Report)

By College Savings Plans Network

September 20, 2012

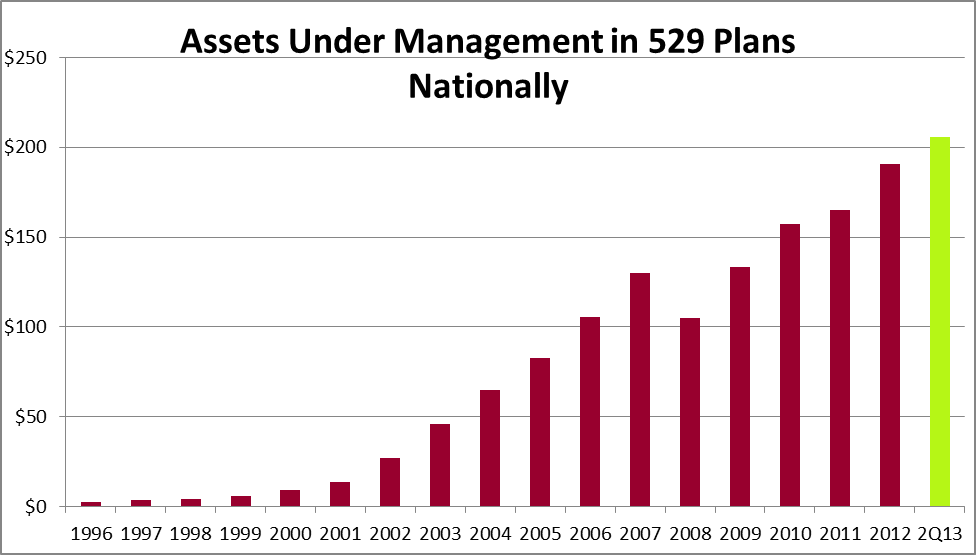

Data collected as part of our 2012 Mid-Year 529 Report indicates that more families are using 529 plans than ever before. 529 plan assets reached record amounts as of June 30, 2012 with $179.02 billion invested nationally. This is an 8.6% increase during the first half of 2012.

The following chart shows annual 529 plan assets based upon data collected by CSPN from 1996 through June 30, 2012.

While total assets increased by 8.6%, assets in the plans increased 4.9% net of contributions and distributions to the plans for the six month period ending June 30, 2012. For comparative purposes, the S&P500; realized a 9.5% increase, and the Barclays Capital Aggregate Bond Index increased 2.4% during the same period. The returns of individual investment options in 529 plans vary due to the account holder’s ability to invest in a variety of investment strategies including fixed income, equities, guaranteed return, or a blend of these strategies. Many individual options offered positive returns during the period.

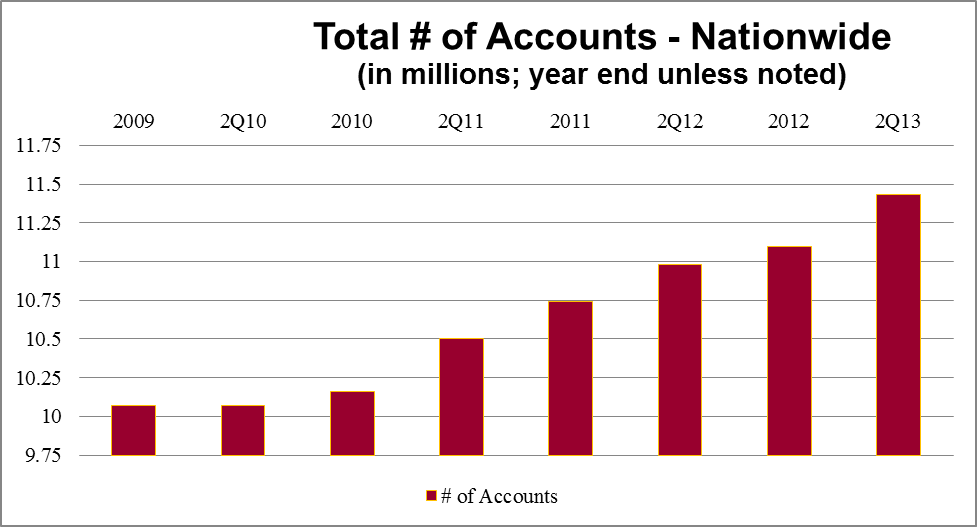

CSPN also found that the total number of 529 accounts continues to increase substantially over the past 30 months, going from 10.07 million in December 2009 to 10.98 million as of June 30, 2012. This indicates a growing awareness among the American public for the need to save for higher education. The following chart shows growth in total number of accounts nationally since the end of 2009.

As our data indicates, total assets and number of 529 plan accounts are steadily increasing, but so is the cost of higher education. According to the U.S. Department of Education’s National Center for Education Statistics, annual prices for undergraduate tuition (including room and board) rose 46% at public institutions and 18% at private institutions between 2000-2001 and 2010-2011.

Each September, CSPN and 529 plans around the country celebrate College Savings Month by promoting awareness of the cost of higher education and how 529 plans can help families meet their college savings goals. Check out 529 plans across the country and compare their features determine how 529 plans can help you achieve your dreams.

About the Author:

CSPN is a national non-profit association and the leading objective source of information about Section 529 College Savings Plans and Prepaid Tuition Plans—popular, convenient and tax-advantaged ways to save for college. An affiliate of the National Association of State Treasurers (NAST), CSPN brings together administrators of 529 savings and prepaid plans from across the country, as well as their private sector partners, to offer convenient tools and objective, unbiased information to help families make informed decisions about saving for college.

CSPN is a national non-profit association and the leading objective source of information about Section 529 College Savings Plans and Prepaid Tuition Plans—popular, convenient and tax-advantaged ways to save for college. An affiliate of the National Association of State Treasurers (NAST), CSPN brings together administrators of 529 savings and prepaid plans from across the country, as well as their private sector partners, to offer convenient tools and objective, unbiased information to help families make informed decisions about saving for college.