(Part 2 in a blog series focusing on prepaid tuition plans)

By Betty Lochner

Director, Guaranteed Education Tuition (GET)

October 15, 2012

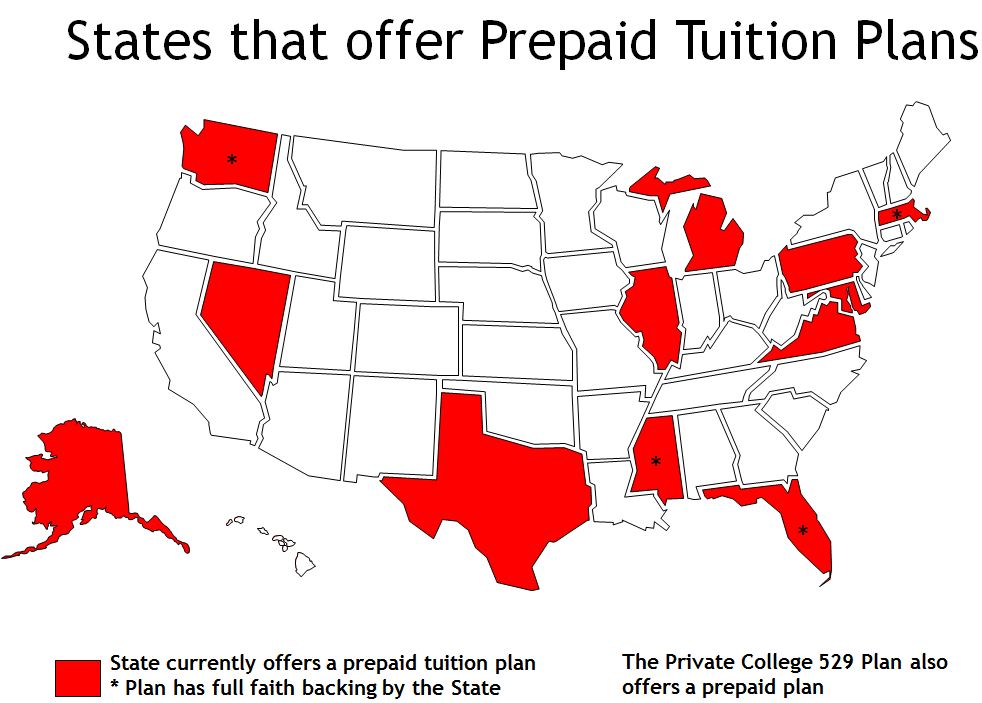

Last week, we introduced you to Prepaid Tuition Plans and gave you some Fun Prepaid Facts. For the next two weeks, we’ll take a closer look at some unique feature of prepaid plans. If your state offers a prepaid tuition plan*, make sure you check out the special features that are offered. If you consider an analogy to retirement plans, Prepaid plans are designed to be a “defined benefit”, as opposed to 529 savings or investment plans which are more like “defined contribution” plans. The defined benefit of a Prepaid plan (which varies by state) may prove to be better or worse than a similar investment in a 529 savings plan, depending upon investment performance and tuition increases during that time.

With a Prepaid tuition plan, you generally know ahead of time what your payout value will be, rather than worrying about the ups and downs of investment markets.

And, while each prepaid tuition plan is different, there are several unique features only offered in a prepaid tuition plan option that make them special. Here are 5 you may want to consider:

Prepaid plans may provide some peace of mind.

The basic premise of a Prepaid tuition plan is that it allows you to pay less now to cover more expensive tuition costs in the future. It is based on a future payout, rather than the ups and downs of investment markets. You do not need to worry about moving investments around within a portfolio.

It can be easier to plan ahead.

Unlike 529 college savings plans, where the increased value of your savings depends upon investment returns, a Prepaid tuition plan offers a defined benefit. You know when you purchase the plan, what it will be worth in the future.

It pays to start early. A Prepaid tuition plan is usually a better deal for those who start early. The greatest increases in tuition costs are usually seen by families who lock into a price in a Prepaid tuition plan as early as possible. It is wise to start when your children are young – babies, toddlers and very young children will benefit the most.

Think Units or Contracts.

Some tuition plans sell units, where units are equal to a future value; and some tuition plans sell contractsfor different types of colleges (2-year, 4-year, housing etc). A unit-based plan allows you to purchase a unit valued at a specific payout value. You can buy as few or as many units as the program allows. Each unit grows at the same rate each year. A contract-based plan can be for a specific college, or type of college and the price will vary based on the number of years or semesters you are buying.

Prepaid plans (except Alaska) have a residency requirement.

That means that either the account owner or the student beneficiary must be a resident of the state at the time the account is opened. Once the account is opened, you can move to another state and still keep and contribute to the plan.

To learn more about a specific Prepaid Tuition Plan, check out our plan comparison tool

About the Author:

Betty Lochner is director of Washington’s Guaranteed Education Tuition (GET) program. Under her leadership, the GET program has grown from 7,900 to over 145,000 accounts, with a fund valued at over $2 billion. Washington is unique in that their only 529 plan offered is a prepaid tuition plan. Lochner currently serves as Vice Chair of the College Savings Plans Network (CSPN) and the Chair of the CSPN National Communications Committee.