(Part 3 in a blog series focusing on prepaid tuition plans)

By Betty Lochner

Director, Guaranteed Education Tuition (GET)

October 19, 2012

Last week, we took a look at some unique features of Prepaid Tuition Plans. In this last part of our Prepaid Tuition Plan series, we’ll take a final look at some additional features of this type of 529 plan.

1. Prepaid plans have different enrollment periods. They are not generally open for new enrollments year round. Some Prepaid plans are open for only a few months, while only a few are open year round. The price generally increases with each new enrollment period.

2. Prepaid plans usually have lower investment limits than the limits set by 529 savings plans. This means that you can usually buy four years of tuition in a Prepaid Plan for much less than the savings limits in a 529 savings plan, since the investment limits in a 529 savings plan are usually $300,000 or more.

3. You don’t have to choose one plan over another. Many families choose to save in a 529 Prepaid plan and a 529 savings plan to diversify your higher education savings.

4. You may get an additional tax break. In addition to the tax-free withdrawal from a Prepaid Plan, you may also get a State tax deduction for choosing your state’s plan.

5. Prepaid Tuition Plans aren’t just for tuition. Even though the name implies otherwise, you can often use your Prepaid Tuition Plan for books, housing, fee and other qualified school expenses. Some Prepaid Tuition Plans may even allow you to use your account for eligible graduate school tuition and fees.

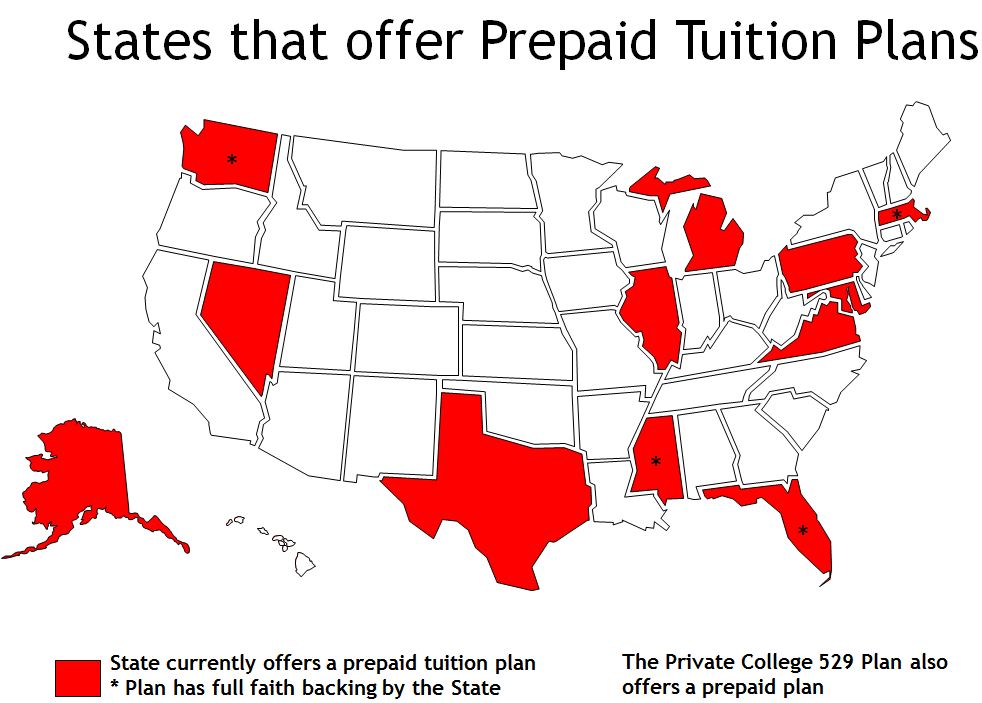

A Prepaid Tuition Plan may be a great option to help you meet your college savings goals. If you live in a state that offers both a Prepaid Tuition Plan and a529 Savings Plan, you may also want to look at whether combining the two options could help you achieve those goals. To learn more about a specific Prepaid Tuition Plan, check out our plan comparison tool .

About the Author:

Betty Lochner is director of Washington’s Guaranteed Education Tuition (GET) program. Under her leadership, the GET program has grown from 7,900 to over 145,000 accounts, with a fund valued at over $2 billion. Washington is unique in that their only 529 plan offered is a prepaid tuition plan. Lochner currently serves as Vice Chair of the College Savings Plans Network (CSPN) and the Chair of the CSPN National Communications Committee.