By Jodi Golden

Director of the Indiana Education Savings Authority

July 3, 2013

Getting ready for a patriotic BBQ? Ribs, chicken, burgers … formula, strained carrots, rice cereal? …It seems that no matter what the occasion, your new bundle of joy comes with a wide range of expenses. However, although diapers and food are obviously necessary, saving for college should also be high on the priority list. With college sometimes 18 years or more away, families may not realize the impact saving early could have. However, if they take a look at the reality of saving, even just a little per month, versus borrowing that amount in the future, it’s sure to open their eyes to the importance of saving now.

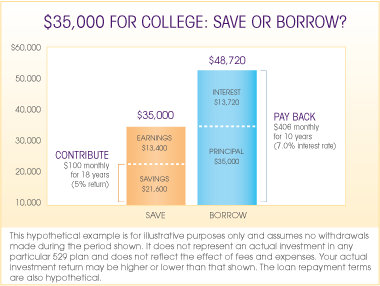

Let’s take a look at a real life example. In this case, Molly’s parents started investing $100 per month into her brand new 529 college savings account. When Molly is 18, assuming a 5% rate of return*, Molly could have accumulated around $35,000 in savings. That’s $35,000 real dollars to put towards her higher education.

However, what if Molly’s parents hadn’t saved each month? So now Molly has to borrow that $35,000 to attend college. Considering a private student loan rate of 7.0%, Molly could be faced with a $406 payment for at least 10 years after she graduates. Including interest she’d actually be paying back around $48,720, an extra $13,720 for borrowing the $35,000 instead of saving it.

These numbers may be scary to some, and each family’s ability to save is going to be different. The point of this real life scenario is to illustrate that although saving may be difficult at times, it’s always going to be cheaper than borrowing later.

Today, students are leaving campus with an average of $27,000 in student loan debt. Do you want your child’s professional life to begin with thousands of dollars of debt?

So this Fourth of July, in addition to the ribs, burgers and strained carrots, think about putting some of that hard earned money into a 529 college savings plan! You can learn about the benefits of saving in a 529 by visiting www.collegesavings.org What’s more patriotic than a great education for your child? It will be the best present you can give them for their future.

About the Author

Jodi Golden is Director of the Indiana Education Savings Authority, which oversees the Indiana CollegeChoice 529 Savings Plans. Under her leadership, Indiana has experienced an over 900% increase in both the number of Hoosiers saving and the amount of Hoosier assets in the plans. Indiana offers a Direct and Advisor 529Investment Plan, as well as recently adding FDIC-insured Certificate of Depositproducts. Golden currently serves on the Communications Committee of the College Savings Plans Network.