By Deena Lager, Director, Arizona 529 College Savings Program

July 11, 2018

Summer is here and that means parents are looking to keep the kids busy with fun and meaningful activities. This is also a great time to help teach the value of savings and financial literacy. Recent studies have highlighted that children establish their financial identities by age 7 – will they be a spender or a saver? Given this finding, there is certainly urgency in identifying opportunities to reinforce positive financial messages.

For many families, summer play time is a great opportunity for these lessons. Activities from family game night to dress up can be used to help teach concepts of financial literacy and saving. By keeping the emphasis on fun, kids see the process as enjoyable and not a chore.

Here are five tips to make sure the whole family is a winner in money matters:

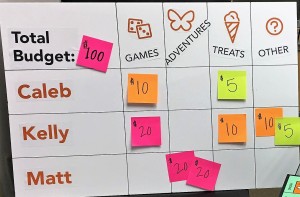

- Make a summer budget for fun! Set a weekly or monthly budget for games, toys and activities for the kids to manage. Can they make the budget last? Can they stretch it out or will they save up for larger, more expensive games or activities? The exercise will help children identify what is important to them and how to make choices based on those financial priorities.

- Use board games to introduce the concepts of money: Whether it is Monopoly, Life, Payday or any other money-based board game, these games present practical examples of budgeting, saving, financial planning and other money concepts. Depending on the game, they may also offer opportunities to talk about future careers and the steps needed to achieve their future goals.

- Relate the concepts to life: For younger kids, books are a great way to learn basic money concepts. Children’s stories can show simple examples of characters’ wants and needs as they relate to money and savings in everyday life. Your child can relate to each character’s story as you discuss what lesson the character learned in the story, what choices would your child make and why.

- Dress up with a purpose: Turn a game of dress up into a chance to talk about careers for the future. What will they have to do to become a doctor, a veterinarian, an electrician, an astronaut or even a firefighter? What will they have to study? How much do they think it will cost?

- Use arts and crafts to help direct the conversation: Work on money-related crafts, such as making a personal savings bank out of a Pringles can or an old pencil box. Little kids especially like the Pringles bank because the lid can become a googly-eyed fuzzy monster mouth that eats loose change! Have the kids decorate the outside of their banks with colors they like, then attach stickers or glue on images of what they want to be in the future, the name or mascot of their future college, or a special item they want to save for.

With a little fun and creativity, you can turn playtime into an excellent chance to talk with your children about some of the most important lessons of money and saving.

With a little fun and creativity, you can turn playtime into an excellent chance to talk with your children about some of the most important lessons of money and saving.

About the Author

Deena Lager is the Director of the Arizona 529 College Savings Program. For almost 20 years, the Arizona Commission for Postsecondary Education has administered the state’s college savings program as Trustee. The Commission currently oversees the program’s 80,000 accounts, which hold over $1.3 billion in assets in three plan options: College Savings Bank (FDIC-insured) or Fidelity Investments, both direct-sold, or the advisor-sold option Ivy InvestEd. Visit AZ529.gov for more information.