by Nancy Farmer, President, Private College 529

March 5, 2018

If you’re like most families, you’re worrying: “I don’t know how I’ll afford college for my children!”

College costs will keep rising. College education is a labor-intensive activity, and we want the best teachers and technology for our children. What can you do to balance many pressing demands for your hard-earned dollars?

You can complete the FAFSA, apply for scholarships, pick a college your family can afford, use available tax credits, and save in a 529 savings plan. But what about a 529 prepaid tuition plan?

Prepaid plans are a relatively small segment of college savings, but should be considered part of a balanced college-savings portfolio. If you could buy a 2028 car at 2018 prices, wouldn’t you?

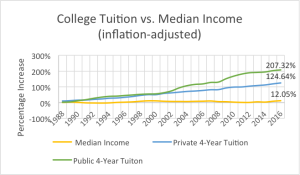

The nearby chart shows why the issue matters – for three decades family incomes have been stagnant, while college costs have risen considerably. It’s not getting much better.

Parents and their children get the picture. A recent survey indicates student debt is the greatest fear of college applicants and parents. Considering student loan debt is greater than $1.4 trillion and rising, those worries aren’t going away.

The state of Washington recently re-launched its prepaid program, bringing to 11 the number of states offering one. Most have residency requirements and while the plans are designed for their own public institutions, the benefits are portable to any eligible school. Congress also has authorized “colleges and their consortia” to operate prepaid tuition plans. The only such plan in operation is one administered by a non-profit group of nearly 300 colleges nationwide, Private College 529 Plan.

No one strategy is right for every family but by understanding the whole range of college financing options, you can avoid the dreaded second-guess: “If only I had known!”

About the Author

Nancy Farmer is President of Private College 529 and former Treasurer of the state of Missouri.

Learn more at PrivateCollege529.com.