By Maria Bruno, Vanguard

October 10, 2016

Higher education is expensive—frighteningly expensive. For most parents, providing for their children’s college education is second only to retirement as their largest investment goal. But even with diligent saving, the first tuition bill may be shocking, so you may want to keep the smelling salts on hand.

To face this fear head-on, you first need a plan. With proper planning, parents may be able to tackle the college tuition bills in an organized and financially sound way. Think it’s impossible? It’s not. Recent research by Sallie Mae reports that families are paying less out of pocket for college as they take advantage of scholarships and grants.¹

Vanguard’s new research, Tackling the tuition bill, provides a practical framework to help you develop a plan. In this blog, I will explore the factors that affect financial aid eligibility.

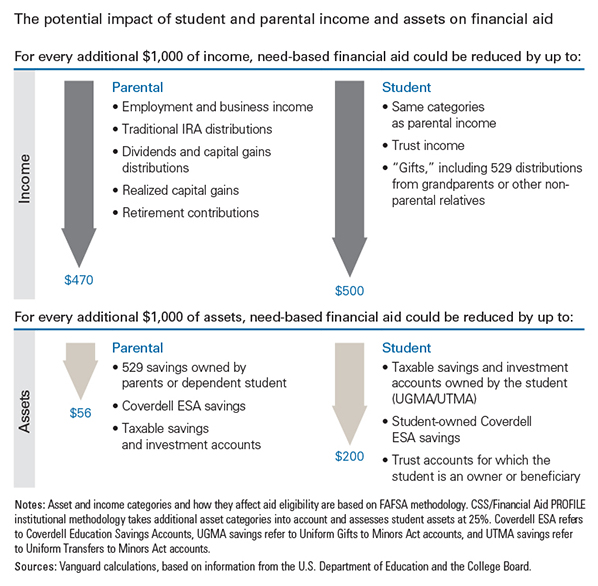

Surely at this point, you know that household assets and income affect financial aid eligibility but that these sources are not treated equally between those of the student and those of the parents. The graphic below summarizes the key points—income matters more than assets, and student income matters more than parental income.

So what does this mean? Obviously, individual circumstances will vary, but here’s a savvy strategy:

Spend your student’s assets first. Because student assets affect aid eligibility more than parental assets (oddly enough, 529s owned by dependent children are considered parental assets), it can make sense to spend student assets before spending from a 529 plan. Such an approach gives 529 savings more time to compound tax-free. And by spending the more heavily penalized assets early, students increase their aid eligibility in later years, when inflation may boost tuition costs.

Tell the grandparents to hold off. Gifts from grandparents and others are considered student income, which has the greatest impact on your student’s financial aid eligibility. As a result, consider tapping those grandparent-owned 529s in the later years of college, when they will no longer be reported or considered in financial aid evaluations.

Don’t drain the 529 right away. Parent-owned assets, including 529 plan accounts, have more limited impact on aid eligibility. Unless you plan to pay for the entire degree with 529 savings, it can make sense to spend from this account strategically over the course of a student’s college career. The account can benefit from continued tax-free growth. You may also be able to time 529 withdrawals to create opportunities for additional aid or benefits.

I realize there’s a lot to think about; but with a bit of knowledge of the rules and some planning, you can tame the tuition bills.

1 Scholarships and grants funded 34% of college costs in the 2015-2016 academic year, up from 30% the prior year. Sallie Mae, 2016. How America pays for college 2016. Accessed October 3, 2016, at http://news.salliemae.com/files/doc_library/file/HowAmericaPaysforCollege2016FNL.pdf.

About the author:

Maria Bruno, CFP®, is a senior investment analyst in Vanguard Investment Strategy Group. She is part of the team that is responsible for establishing and overseeing the investment philosophy, methodology, and portfolio construction strategies used to support Vanguard’s advisory services, products, and strategies. Ms. Bruno’s areas of expertise include portfolio construction and financial planning, with specialization in retirement planning topics, retirement income solutions, and wealth management strategies.