Tip #1

September 1, 2013

529 savings and prepaid tuition plans can be used at virtually any accredited college or university in the U.S. and even at some foreign schools. They can also be used at eligible trade and technical schools.

Tip #2: Be Prepared – The Cost of an Education is Rising

September 2, 2013

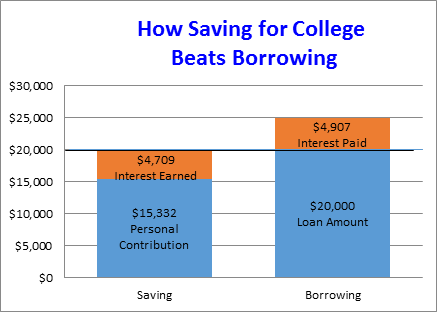

The average cost for tuition and fees at four-year public institutions has increased nearly 51% over the last 10 years. Saving for college with a 529 plan can help with the increasing cost and help you be financially prepared when your children are ready for college.