By Patricia Roberts, CSPN Corporate Affiliate Chair

February 12, 2018

Valentine’s Day is a fitting time to remind those we love just how much we care about them. While there’s no shortage of easy-to-give chocolate, floral or teddy bear-type gift options, taking a few minutes to establish a college savings plan for a child’s future is a great way to show you care — and a heart-warming gift your entire family will appreciate for years to come.

And, there’s a lot to love about 529 college savings plans:

- You’ll love the versatility.

529 college savings plans can be used at a wide range of post-secondary schools across the country. Whether your child decides to attend a two-year or a four-year college, a trade or technical school, or decides to pursue a graduate or professional degree, 529 plan investments can help tremendously. The funds you save can even be used at some international colleges and universities as well. You’ll love the places they’ll be able to go!

- You’ll love the tax benefits.

529 plan investments grow tax deferred (meaning, unlike other forms of saving and investing, you won’t pay tax on the earnings as your account grows) and the growth will never be taxed as long as withdrawals are used for qualified higher education expenses such as tuition, fees, room and board, books and supplies, and computer expenses. And on top of the favorable federal tax treatment, over thirty states offer a tax deduction or credit for 529 account contributions. Less taxes means more savings!

- You’ll love the many ways to contribute.

Many 529 plans have low initial deposit minimums (as low as $25 or less in some cases), making it very easy to get started. Funding the account is easy too. Initial and subsequent contributions by check are welcomed and for those wishing to contribute on an automatic basis, many plans allow recurring contributions to be made from one’s paycheck, savings or checking accounts. As an added benefit, it’s easy for friends and family to contribute too. Everyone wins when contributions are made easy!

- You’ll love the flexibility.

If the child for whom you originally set the account up chooses not to go to college, you can change your account beneficiary to another family member with no penalty or cost. This could be a sibling, spouse, cousin, aunt, uncle, step-child, niece, nephew and so on. You can even use the money for your own education or save it for your child’s children!

- You’ll love the example you’ve set and the peace of mind that comes with being prepared.

Showing the children in your life how to defer immediate gratification and how to save a little at a time for long-term goals is a great way to empower them for the future. It’s also a great way for your family to avoid the heartbreaking consequences of having not planned ahead for college costs. When college rolls around, far too many students cannot afford to attend the schools to which they’ve worked so hard to get accepted; they become saddled with unmanageable amounts of student loan debt and/or need to drop out before completing a degree due to lack of resources. Planning ahead can help avoid potential heartache such as this.

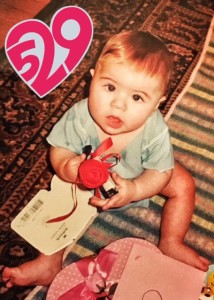

Still Close at Heart

On a personal note, on my son’s very first Valentine’s Day, I could never have imagined just how quickly he would grow from an eight-month-old toddler to an 18-year old college freshman. Having a plan helped to make his transition to college a smooth one and knowing he’s pursuing what he loves warms my heart each day.

About the Author:

Patricia Roberts has been a part of the 529 industry for over 17 years, serving as an attorney, product manager, state relationship manager, and currently, as chair of the CSPN Corporate Affiliate Committee.