By Joseph Russo

September 8, 2015

If you read anything about paying for college these days, you may have seen a column or two in which the author lamented that “back in the day” a student could earn the year’s tuition by working a summer job.

Of course, those times are past. Given the rising cost of college, higher education has to be paid for over time, like retirement or a home. There are basically two options:

• Save money in advance and earn interest, especially in tax-advantaged 529 plans

• Borrow money during college and pay interest afterward

Since September is Saving for College month, it is no surprise that I advocate saving. A family is better off saving more and borrowing less.

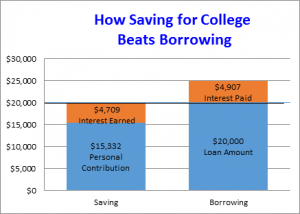

Saving makes college less expensive. Assume a family needs $20,000 for college costs. The student could take out a loan at 4.5% to be paid back in monthly payments of $207 for 10 years after he or she graduates. By the time the student retires that $20,000 debt, he or she will have spent $24,907.

Assume that same family starts saving for the child 10 years before he or she begins college and puts away an average of $128 a month. If investment returns average 5%, the family will only have to contribute $15,213 to gain $20,041 to spend on college. And the $4,709 gain is federal tax free*

The net gain from saving over borrowing amounts to $9,575 for the family.

Saving has minimal effect on financial aid. Money saved by parents in a 529 account belongs to them and affects potential aid by no more than 5.6% because of multiple factors in the federal financial aid formula (FAFSA). For example, a two-parent family has two children – one in college – and $20,000 in a 529 account. The savings have no impact on the expected family contribution. If that family had $50,000 in the account, the potential aid might be cut by about $1,200. But, remember that there may not have been any aid to begin with or the aid that was offered was in the form of a loan (vs. a grant). What is important to understand that eligibility for aid is not the same thing as entitlement.

Students with savings are more likely to attend college and graduate. Research published by Washington University in St. Louis shows that students with dedicated college savings – even less than $500 – are 2.5 times more likely to attend college and earn a degree.

One final thought: it will always be better to have planned and saved for a student’s college costs than not to have done so. Having resources such as those funded through 529 accounts will provide the student with more choices and result in enhanced access and affordability. Having saved for college will also reduce stress. What greater gift can a family provide?

* Your state-sponsored 529 plan may offer additional tax advantages.

Mr. Russo is the retired director of Student Financial Strategies at the University of Notre Dame, which actively promotes planning and saving for college. He also serves on the Board of Trustees of Private College 529 Plan, a prepaid tuition program owned by 280 private colleges and universities nationwide.