Let’s face it; there’s a lot of uncertainty and instability in the world right now – look no further than the ups and downs of the stock market. This volatility may keep some investors on the sidelines, while others may try to time the market, which can be risky.

If you’ve been thinking about saving for your child’s post-secondary education, you may be surprised to learn that now is an ideal time to start investing in a 529 college savings plan. Most 529 accounts can be opened with a minimal initial investment, and setting up recurring contributions in an amount that fits within your budget is simple.

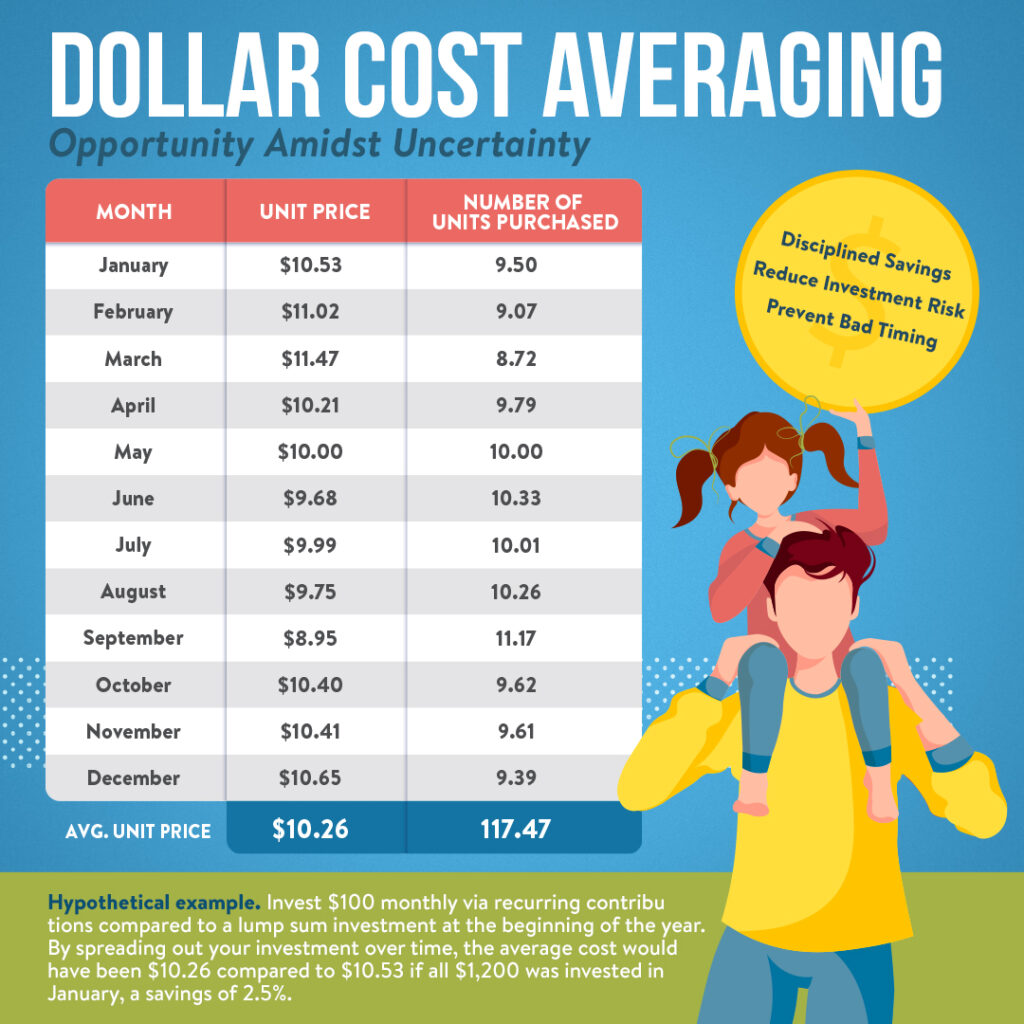

Continuing to invest through regular, ongoing contributions–even in challenging times–can potentially add up. This investment strategy, often called Dollar-Cost Averaging, is when people invest their money in equal portions, at regular intervals, regardless of the ups and downs in the market. It may help minimize the impact of market volatility while potentially enhancing returns over the long haul.

For example, let’s say you have $1,200 to contribute to your college savings account at the beginning of the year. You decide to invest $100 monthly via recurring contributions rather than the entire amount at once. Throughout the year, when the market is up, your $100 will buy fewer shares, but when the market is down, your $100 will buy more. Over time, this strategy could lower your average cost per share compared to a lump-sum investment where you may have bought all your shares when they were more expensive than the average. See the chart below for cost comparison and the potential benefits of dollar-cost averaging.

You may already be practicing dollar-cost averaging in other areas of your life and not realize it, perhaps with a retirement account. An excellent way to help your college savings grow is to make sure contributions are a regular part of your monthly bills. Recurring contributions make payments easy and predictable, so they become a regular, expected expenditure within your monthly budget. When saving for a student’s post-secondary education expenses, it’s not about trying to cover the entire cost – it’s about saving as much as possible within your means. While occasional lump sum deposits like a tax refund can be a great way to leap forward, focusing on small amounts and investing steadily can be a more tangible plan.

So don’t let the market’s unpredictability keep or delay you from investing in your loved one’s future. Opening a 529 college savings plan and setting up recurring contributions – even in small amounts – can potentially add up to big savings down the road.

About the author:

Jessica Wetzel is the State of Wisconsin College Investment Program Finance Officer.