Make this new year count for education savings. Start with a 529 plan.

Open a tax-advantaged 529 account

Prepare for future qualified education expenses by choosing a 529 plan as your investment vehicle. Start by looking at your state’s 529 plan, which may offer state income tax benefits in addition to the federal tax benefits already in place. Earnings accumulate tax-deferred from federal income taxes, and withdrawals are tax-free for qualified education expenses like tuition, fees, books and supplies, and room and board.

Beneficiaries can attend college, university or technical school at eligible institutions across the United States and abroad with 529 funds, too.

529 funds can also be applied to K-12 tuition expenses and student loan repayments for a beneficiary or sibling of the beneficiary, up to certain limits, as well as registered apprenticeships. See your 529 plan for details.

Set up automatic contributions

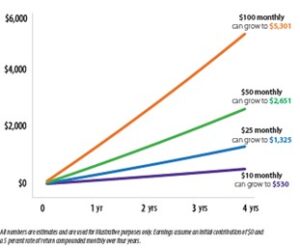

Set up automatic contributions so you can contribute to your 529 account without giving it a second thought. Save for future education expenses according to your budget and your timetable. Scheduling contributions means you can save regularly, giving 529 funds more potential to grow.

Whether you save a little or a lot, building the habit of saving regularly can make a difference. Keep in mind that the concept of compound interest can help, too. That’s where the earnings on your investment can generate additional returns. As returns are reinvested, it can create a snowball effect that can help you meet future financial goals.

Incorporate special occasions into your savings calendar

Make birthdays, holidays, special occasions and milestones a savings opportunity with a contribution to your beneficiary’s 529 account. Every time you celebrate, resolve to contribute even a small amount toward your beneficiary’s education. It connects important dates to the habit of saving, and it reinforces preparing now for future educational goals.

About the author:

This article is courtesy of my529, Utah’s official nonprofit 529 educational savings plan. It is the nation’s third-largest direct-sold plan with over 400,000 accounts and billions in assets under management. my529 has been helping families across the United States invest for higher education for more than 25 years. Accounts are free to open and require no minimum deposit.