By Steve Jobe, Senior Vice President, Vestwell

February 20, 2024

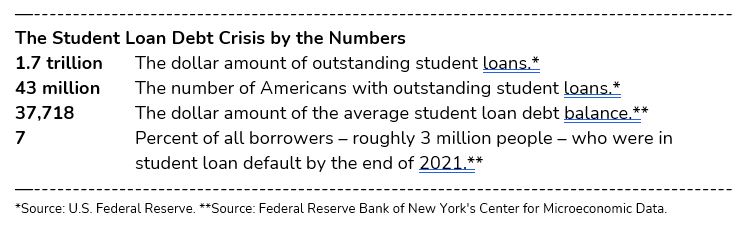

Anyone who’s been or has sent a child to college knows firsthand how expensive obtaining a degree can be and how quickly that cost has risen. Just how big a problem is this? How can we address the damage already done? Who can help Americans avoid the burden in the future?

The amount of student loan debt is staggering. And, the number of Americans affected is significant – over 15% of adults in this country. Student loan debt is both a burden for American families and a drag on the country’s economy. Perhaps you’ve experienced this firsthand – did you put off contributing to your 401(k) because you had too many student loan payments left? According to Vestwell’s annual “Saving Trends Report, 93% of survey respondents with student loans reported that their student debt had affected their ability to save. Other common delays include moving out of the parents’ house, or buying a new car or a first home.

Employers to the rescue. Thankfully, there are workplace solutions to help employees repay their student loans. Employers have begun using services such as Gradifi, a benefit service that gives employers a simple, streamlined way to provide a match to employees who are still repaying their student loans.

Of course, the best way to reduce student loan debt is to incur little or none in the first place. So what can the average American do to best prepare for this future cost? Take advantage of the two things everyone has at their disposal: time and the tax benefits of a 529 plan.

One boost to incorporating 529s in the workplace has come from several states that provide tax credits to incentivize employers to promote savings in a 529 plan. Currently, Arkansas, Colorado, Idaho, Illinois, Nebraska, Nevada, and Wisconsin offer tax benefits to employers who match their employees’ contributions to a 529 plan. Along with this financial wellness strategy, many employers already make it easy to contribute to a 529 plan by allowing employees to make a contribution through the payroll process. These types of incentives are helping to spread the word about the benefits of saving for future education expenses instead of relying on student loans.

Why 529 Plans? As those who frequent this blog know, 529 plans are tax-advantaged savings plans to help offset the cost of higher education. They can be opened by anyone and assigned to any beneficiary – a child, a grandchild, a niece or nephew, a friend – even yourself or your spouse. 529 plans are sponsored by states, so their rules – such as tax incentives – differ from state to state. However, in all cases, the money grows on a tax-deferred basis. As long as it’s used for “qualified” education expenses, future withdrawals aren’t subject to either state or federal taxes. They can even be rolled into a Roth IRA now if eligible balances remain in the account.

However, according to the same survey, only 42% of savers are at least somewhat aware of the tax benefits of 529 Plans, and less than 5% of those surveyed with a Vestwell-managed 401(k) currently have one. So, while the benefits of starting a 529 plan are numerous, too many Americans need to be made aware of them, and fewer take advantage.

A 529 plan might be an effective way for you to help someone you love reduce reliance on future loans, and with many employers beginning to offer them as a part of their benefits and financial wellness offering, they can be set up easily to prepare for future educational expenses. Check with your benefits provider or HR department to ensure you are fully aware of all financial wellness benefits you may be eligible for. Open an account and start saving as soon as possible; regardless of how much you contribute, every dollar saved reduces the amount of student loan debt in the future.

About the Author

Steve Jobe is a Senior Vice President at Vestwell, where he oversees strategy and relationship management of the firm’s 529 and ABLE programs. Steve also serves on the College Savings Foundation’s Board and the Municipal Securities Rulemaking Board (MSRB)’s Municipal Fund Securities Advisory Group.