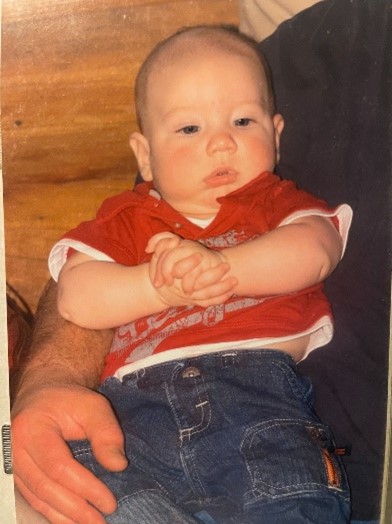

Just yesterday, you were cradling your sweet baby, and today, here you are with an 11th-grader quickly approaching college entry. Cue your best Edvard Munch’s ‘The Scream’ impersonation as you grapple with the idea of financing your child’s academic pursuits. Whether you are still in the early days of parenting or you’ve recently experienced that scream moment, the question about financing future education costs can seem scarier than meeting a hairy monster in a dark alley. Let’s face your college financing fears head on, together.

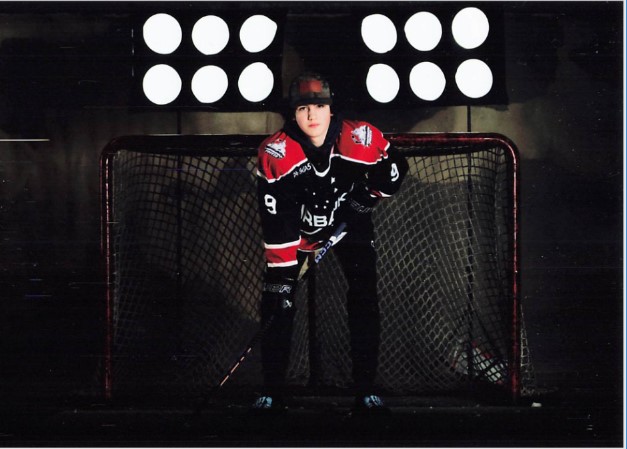

My very wise teenager offered this advice in conquering fears. Picture us standing on the edge of a treacherous trail in the Grand Canyon. I was paralyzed with fear about the path forward. They said, “Take a deep breath, get started, hold my hand, take it one step at a time, and keep going. You got this, Mom.”

Let’s break down the advice and apply it to facing the college financing fears, shall we?

- Take a deep breath. Everybody freaks out. It’s going to be okay. When fear sets in, it’s helpful to pause and assess the situation. Think about these questions as you start to set your goals: Do you have anything saved? What do you think you can reasonably save before enrollment? Are you expecting to finance 100% of your child’s education? What is a reasonable goal for you?

- Get started. This is an obvious and critical first step, but you have to start somewhere. What does getting started look like? Maybe it looks like this: setting a goal, researching the options, or taking action. Wherever your start line is, go there, and take the first step forward.

- Find someone to hold your hand. It’s not always easy to ask for help, but the proverbial college financing ‘wheel’ doesn’t need to be recreated. There are thousands of experts available to help chart a course that will make sense for your family. Don’t forget about the impact relatives, friends, and grandparents have during this process. Consider asking for gifts of education in the form of contributions to your 529 account. Ask for guidance from other parents who have “been there, done that.” Finding someone to coach you and shine a light on the unknown can suddenly help illuminate your way forward.

- Take it one step at a time. Now that you can see the path forward, it’s time to start moving. If your beneficiary is closer to diapers than college enrollment, consider setting up a systematic savings plan like direct deposit from your paycheck or automatically contributing from your bank into a 529 account. This allows you to set it and forget it. It also let’s time work on your behalf. If college is just around the corner, think about those same strategies, and also research scholarships and federal aid options.

- Keep going: Make consistent and meaningful progress forward. Every dollar saved today is two you won’t have to pay back later in student loan interest. It’s easier than you might think to save a little from each paycheck with direct deposit.

There, suddenly that big hairy monster is actually a soft cuddly kitten in a well-lit alley. You got this!

About the author: Lael M. Oldmixon, M.Ed., is the Executive Director of the Education Trust of Alaska, which offers Alaska’s three 529 plans, Alaska 529, the T.Rowe Price College Savings Plan, and the John Hancock Freedom 529. She lives in Alaska with her spouse, two children and two dogs.