By Jenn Dyck, Communication & Marketing Specialist, WA529

Memories of planning family road trips always come to my mind in the first weeks of summer. Preparing for an exciting adventure is a rewarding experience. I planned several fun-filled road trips when our kids were young – creating special memories our family will never forget. Recently, it occurred to me that saving for higher education may seem like a completely different task, but honestly, the two tasks are more alike than you might think. Road trips are often filled with laughter, spontaneous detours, and roadside treats, while a college savings journey requires financial planning, dedication, and long-term commitment. Yet, at their core, both are fueled by dreams, driven by hope, and shaped by meaningful preparation.

Choose the Destination

Every memorable road trip begins with a vision. Whether your family dreams of a cross-country drive to a theme park or exploring local attractions, families choose destinations that excite them. This first step builds hope and anticipation, giving everyone something to look forward to.

Similarly, saving for higher education begins with a dream. Students and their parents picture a future shaped by college degrees, technical or vocational training, or apprenticeship opportunities. Taking the step to save in a 529 plan supports different paths your student may choose and builds hope that they can pursue their dreams after high school.

Plan the Route

Mapping your road trip route includes carefully planning desired sights, rest stops, meals, overnight stays, and fuel stops. Families often weigh the pros and cons of adding time and money to take paths leading to specific sights and landmarks they want to see, compared to taking the fastest highways to their destination. Flexibility and budgeting are the keys to balancing family fun with trip finances.

When beginning their savings journey, families consider how much to set aside for their children’s dreams, what type of 529 plan to use, and how to balance education savings with other financial goals. Just like a road trip, dreams and desired paths may change along the way, but a carefully planned roadmap—saving what you can, when you can—helps your child reach their final destination.

Pack the Essentials

Smart road trippers pack strategically for their families’ needs—weather-appropriate clothing, food, snacks, entertainment for kids, emergency kits, and roadmaps. These essentials contribute to a smooth and enjoyable journey.

The same is true when hitting “Route 529.” Knowing the best financial tools is essential. From tax-advantaged 529 savings accounts to automatic payments and flexible spending options, families benefit from “packing” the right resources early on. Like a well-packed bag, 529 savings accounts reduce financial stress later.

Stay on Course

Even well-planned road trips run into delays—traffic jams, closed attractions, road detours, or weather issues. Families often need to adjust their plans to stay on course and avoid unexpected obstacles. Keeping a positive attitude and making the best of these detours shows our kids how flexibility and dedication can lead to a successful outcome.

During your savings journey, life may throw curveballs—job changes, medical expenses, or unexpected downturns. Staying committed to saving, even small contributions, helps families move closer to their goals. Flexibility might mean temporarily adjusting contribution amounts and timelines. In the end, consistency pays off. Every dollar saved is a dollar not borrowed later.

Share Experiences

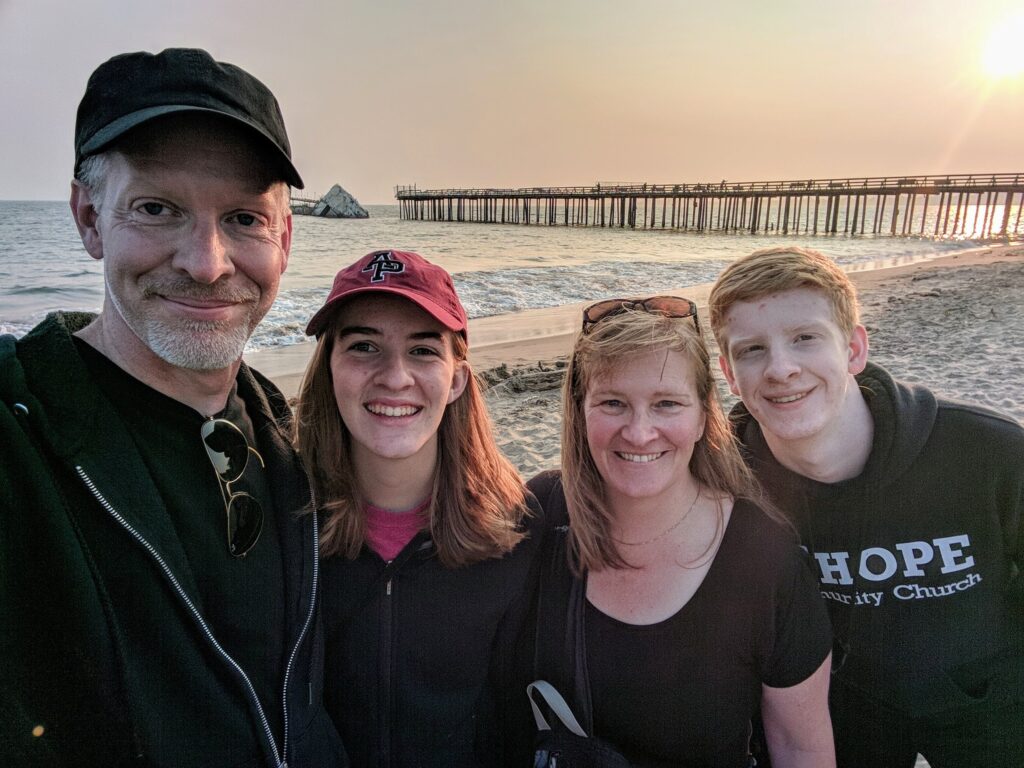

Beyond the sights seen and photos taken, the road trip’s real value lies in the bonding moments—playing road trip games, singing in the car, or late-night talks at a hotel or campground. Often, road trips also involve enjoying time with extended family or close friends.

Saving for higher education dreams is also a family affair; family and friends are usually happy to be a part of your savings journey. Including children in their higher education savings efforts teaches them about responsibility, planning, and the value of investing in their future. Sharing dreams and group savings efforts create family bonding, just like a family road trip does.

The Destination

Arriving at your chosen destination isn’t the end of the road—it’s a new beginning of exploration and more memories in the making. All the planning efforts pay off. The time spent together as a family is priceless.

As the 529 savings journey comes to an end, a new one begins. When a child settles into a college campus, starts classes at a vocational school, or begins their apprenticeship for a dream job, years of savings and planning come to fruition. It is the beginning of their grown-up path, supported by a foundation laid by their family.

Let the Adventure Begin

Family road trips are measured in miles covered and memories made, and education savings are measured in time and dollars. Both represent powerful investments in experiences and opportunities. Planning for both requires a vision, dreams, flexibility, and commitment—ultimately providing rewards far beyond the desired destination. Watching my children graduate from college with very little student loan debt was well worth the time and effort spent saving for their futures.

Whether you’re hitting the open road this summer or forging the path to your child’s dream, remember that preparing for the journey is just as important as the arrival. Your next great adventure starts with a single step! Explore the benefits of saving in a 529 plan in your state.

About the author:

Jenn Dyck is a Communication & Marketing Specialist for Washington Education Savings Plans (WA529). Jenn lives in the Pacific Northwest and is passionate about encouraging others to pursue higher education. Recently, she returned to college to complete her bachelor’s degree at the same time her two young adult children earned theirs. WA529 helps families save for educational expenses, with a vision of fostering a well-educated community by helping students and families overcome financial barriers to education and avoid future debt. WA529 offers families tax-advantaged 529 plan options to save for future college and career training expenses: the GET 529 Prepaid Tuition Plan and WA529 Invest Education Savings Plan. Visit 529.wa.gov for more information.