529 plans are designed to encourage early and consistent savings by offering an easy, affordable and convenient way for families to save for college. While the tax advantages are one of the primary benefits, states also offer a variety of features and benefits to help families reach their college savings goals.

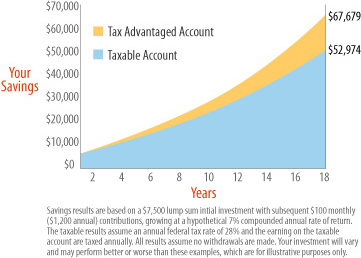

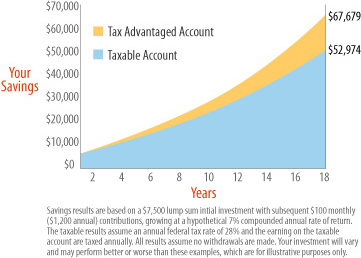

This chart shows the difference between saving with a tax-free account like a 529 plan versus saving with a taxable account.

- All money grows federal and state income-tax free

- All withdrawals used for qualified higher education expenses are exempt from federal income tax

- Many states also exempt withdrawals from state income-tax for qualified higher education expenses

- The account holder retains control of the assets within the program regardless of beneficiary’s age

- Most plans have very low minimum monthly contribution limits making them attractive to families regardless of income level. Some states have minimum limits as low as $15.

- The beneficiary can be changed at any time to another member of the beneficiary’s family

- Money can be used at virtually any accredited college in the country

- Money can be used to pay for tuition, fees, room, board, books, supplies and required equipment

- Contributions can be made conveniently through payroll deduction or automatic transfers from a bank account

- Many states offer maximum contribution limits of $300,000 or more

- Assets within 529 plans are protected from bankruptcy

- Most states offers a low cost option that can be opened by contacting the plan directly

- 529 plans are also offered through professional financial advisors who can help you choose a 529 plan and an investment strategy to meet your needs.

- Account owners can make a lump sum contribution of up to $70,000 per beneficiary or $140,000 if married filing jointly and avoid incurring a Gift Tax on this amount by electing to use five years of the annual gift tax exclusion all in one year. After utilizing this provision, the annual exclusion cannot be used again for the same beneficiary until the five year period has passed. Should a donor die within those five years, a pro-rata amount of the gift will revert back to their estate and be treated as a taxable gift

To better understand how 529 plans fit within the U.S. Dept. of Education Federal Financial Aid formula read: CSPN Report: Financial Aid Process Favors Saving for College May 2011